Eye on electricity

Forward price dip following new Tiwai smelter contracts

- Wholesale

- Prices

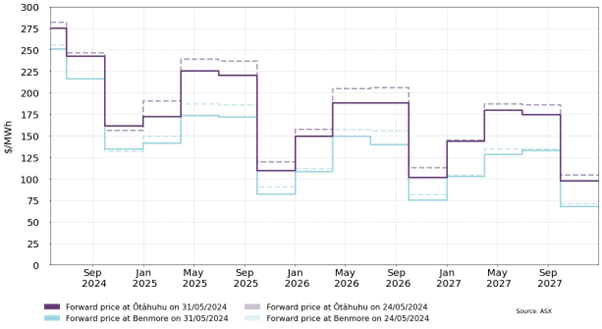

On 31 May 2024, three of New Zealand’s largest electricity generators (Meridian, Contact and Mercury) announced new contracts of up to 20 years with New Zealand Aluminium Smelter (NZAS). Shortly following this announcement there were changes to future electricity prices, as outlined below.

The forward price curve indicates the markets expectation of future average spot prices

In an earlier article, we looked at the forward electricity market and factors that influence price expectations in the electricity spot market. This article explains that the forward curve is the market’s expectation of future electricity spot prices, and how factors like hydro conditions, investments and future demand expectations can affect forward curves.

Since late winter 2023 the forward curve has shown a downward trend, indicating a long-term fall in the electricity spot price. Some of this drop in future spot prices is likely due to the current and anticipated investment in generation. The Electricity Authority has published a review of investment showing greatly increased plans to invest in generation. The prospect of future investment in generation can lower long dated futures and show a downward trend in the forward curve.

After the announcement of the 20-year Tiwai deal, forward prices dropped

The Tiwai aluminium smelter is located in Bluff and consumes roughly 13% of New Zealand’s total electricity output. In 2020, NZAS and Merdian Energy agreed to an electricity deal which lapses at the end of 2024.

After the May 2024 announcement regarding a long-term deal with NZAS, forward prices dropped, as seen in the chart below. This could be due to the long-term nature of the electricity agreements and the demand response as part of these agreements.

The length of the deal, and further demand response options, will likely contribute to future investment certainty. Long term agreements such as these play an important role in future stability of the electricity sector. A stable and plentiful investment environment is important for the highly renewable future of electricity generation and the timeline of future generation pipeline.

A 20 year deal gives more certainty to generation investors that the smelter is here for the long term. This makes it easier to commit to generation investments.

There is also significant demand response built into these new contracts. Demand response will likely become more important given the upcoming increase in intermittent generation and the consequent need to accommodate variable output from this generation.

Materially large contracts, like this recent Tiwai deal, need to comply with the Electricity Industry Participation Code 2010 (Code)

In 2023 the Electricity Authority made a permanent Code amendment to address the potential for inefficient price discrimination in very large contracts. For the deal between NZAS and the three generators, the Authority has reviewed these materially large contracts and the Mercury and Meridian and Contact decision papers are now published.

Related News

Feedback sought on relief during times of market stress

We are seeking feedback on whether to allow an urgent Code amendment implemented in response to winter 2024 market stress to expire, or to make it permanent.

Authority comment on permitted circumstances for market makers

The Electricity Authority provides its expectations of any market maker intending to issue a Permitted Circumstance notification based on a potential breach of…

Keeping an eagle eye on security of supply

The latest quarterly Security of Supply outlook from system operator Transpower highlights some of the challenges the system faces as we head into winter.