Eye on electricity

Gentailer energy margins in 2024

- Generation

- Retail

Following the significant spike in wholesale electricity prices during July and August 2024, the Electricity Authority Te Mana Hiko (Authority) requested that all gentailers supply weekly energy margin data.

This article shares the findings from this energy margin data from July to December 2024 and explains how wholesale prices, energy margins and profits are related.

What is the energy margin?

The energy margin is the difference between the total revenue earned from generating electricity and the total costs incurred in generating that electricity. It is not generators’ profits, as operational costs such as staffing, office overheads, maintenance and repairs are not included.

However, the energy margin is a measure of profitability. That is, if energy margins are particularly high (or low) for a short period, it indicates that profits could be particularly high (or low) at that time.

How we calculate energy margins

The Authority used its information-gathering powers to require gentailers - Contact, Genesis, Mercury, Meridian, Manawa1 and Nova - to submit weekly energy margin data to us between July and December 2024.

We analysed this data and published it as part of our review of winter 2024.

View energy margin data dashboard

To calculate the energy margins, we requested several revenue and cost components from the gentailers, including:

- Generation revenue – the revenue gentailers receive from the wholesale market for generation sold at the spot price

- Ancillary market revenue – the revenue from the ancillary market for providing reserves and other security products, minus any costs paid into the ancillary market (such as paying for reserves when a generation unit is the risk setter)

- Other revenue – all fixed price electricity contract revenue - energy component only - from physical and financial contracts, including mass market, commercial, industrial, contracts for difference (CfDs), Australian stock exchange (ASX) and premiums

- Spot electricity costs – the floating costs and revenues from physical and financial contracts associated with the wholesale spot price, including mass market, commercial, industrial, CfDs and ASX

- Direct generation costs – the direct costs of generating electricity such as fuel and emissions charges.

We did not include the opportunity cost of water, operating expenses, such as staffing, maintenance and repairs, and levies.

Wholesale conditions varied significantly

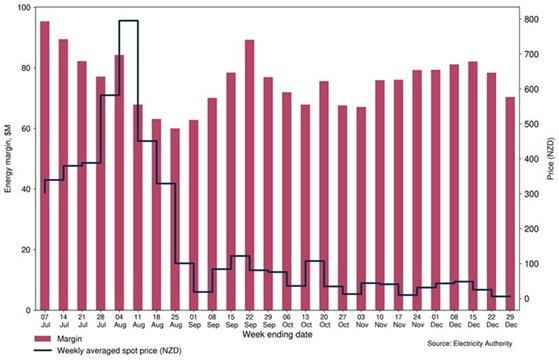

The total energy margin across all gentailers (Figure 1) varied from $60 to $95 million per week from July to December 2024, with an average energy margin of $76 million.

Overall, energy margins decreased between the weeks ending 7 July and 18 August, then rose until the week ending 22 September 2024. The exception was 4 August when margins were higher than the surrounding weeks, and 29 September when margins fell. From the end of September to the end of December, the total energy margin was mostly below $80 million.

The higher energy margin for the week ending 4 August appears to be due to revenue from fixed price contracts, which was $107 million, compared to the average of $76 million. This is likely due to high electricity demand during this week, which increased revenue from retail customers. The high energy margin in early July was also likely related to high demand.

When the total energy margin was lowest, the cost of direct generation (fuel) was the highest. In early August, high gas prices for thermal generation resulted in direct generation costs between $36 and $39 million per week. In contrast, in September when there was a higher amount of renewable generation, direct generation costs dropped to around $13 million per week.

When inflows increased hydro storage in the latter part of the year, spot electricity prices dropped. However, energy margins remained close to $80 million during November and until the last week of December when demand decreased.

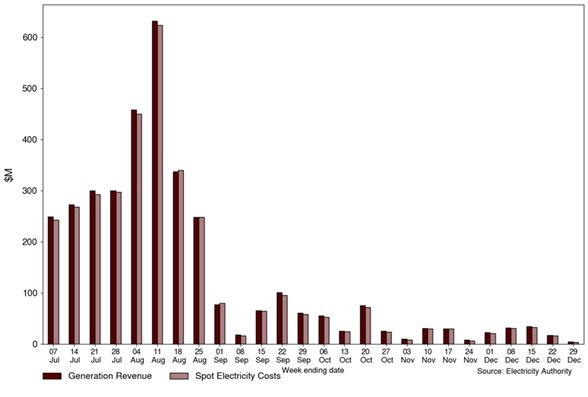

The generation revenue and spot electricity costs are directly related to wholesale electricity spot prices (see Figure 2). Both were highest in the week ending 11 August 2024, which was the week with the highest spot prices, with generation revenue at $632 million and spot electricity costs at $622 million.

Both generation revenue and spot electricity costs dropped in September as spot prices dropped. From the last week in September to the end of December, generation revenue and spot electricity costs were mostly below $60 million.

How margins were impacted

In August 2024, high electricity spot prices significantly increased total generation revenue, but this did not translate into higher energy margins. In the weeks ending 11 August and 9 September, the energy margin was similar, but the generation revenue differed (see Figure 1). This was due to different conditions in the market, such as total wind generation, total electricity demand and contract positions.

The gentailers are also the main buyers when electricity spot prices are high, so the net impact of high prices is small. However, the financial risk or exposure of individual electricity generators to high market prices can vary from week to week. This variation depends on how much electricity they produce compared to their contractual obligations.

If a generator produces more electricity than its obligations, it might benefit from selling the excess at high prices. Or, if it produces less, it might have to buy additional electricity at high prices to meet its obligations, increasing its costs.

Each gentailer had a higher energy margin in the weeks when they produced the most electricity. For example, Genesis' revenue was highest when they had all three Rankines and Huntly 5 generating, while Contact and Mercury benefited from high inflows into their hydro schemes in September.

Nova has the smallest generation capacity and so had the lowest energy margins in most weeks. Nova's energy margin was highest at $5 million in the week ending 11 August, due to the high use of its peaker units that were brought online quickly to meet peak electricity demand.

Nova has stated that its energy margins overstate the profitability of its business as they buy gas from Todd Energy at a set price. Todd’s profits have dropped because they are producing less gas but have relatively fixed production costs.

Energy profits in 2024

The average weekly net profits for the four gentailers for July to December 2024 is -$4.65m for Meridian, $3.6m for Genesis, -$2.58m for Mercury and $5.46m for Contact, as published on their websites (Meridian, Genesis, Mercury, Contact).

The gentailers generated less profit than for the same period in 2023 except Genesis – which generated significantly more electricity in 2024 compared to 2023, so had a higher profit level.

More investment is needed in electricity generation

The high wholesale electricity prices in winter 2024 are a strong signal that more investment in New Zealand’s electricity generation is needed to keep up with increasing demand.

The Authority is working with Transpower (as the system operator) to improve visibility of new generation projects underway. The gentailers’ active new generation projects include:

- Contact is building the 168MW Kōwhai Park Solar Farm in Christchurch, expanding their geothermal generation by 51MW next to its existing Te Huka plant and developing a 100MW battery at New Zealand Steel’s Glenbrook site

- Meridian is building 120MW of solar generation in Northland’s Ruakākā, has consent for a 90MW wind farm in the Wairarapa and has a 50-50 joint venture with Nova to build and operate the 400MW Te Rahui solar farm near Taupō

- Genesis has confirmed three new North Island sites for solar farms with 400MW of renewable electricity capacity in Manawatu, Waikato and Hawke’s Bay

- Mercury are building a new 77MW wind farm near Dargaville and extending its geothermal capacity at Ngā Tamariki by 46MW.

Independent developers are also investing in electricity generation: we understand from our 2023 generation investment survey that 51% of all committed generation projects are from non-gentailer entities.

The Electricity Authority has a programme of work underway to support increased investment in electricity generation. We are actively monitoring competitive outcomes and constraints to investment, as well as providing data to inform and support investment decisions.

1. Manawa sold the mass market retail branch to Mercury in 2022, but still serves some commercial and industrial customers.

Related News

60 organisations practice system-wide emergency response

Last week 60 organisations joined forces to take part in the Industry Exercise 2025 and tested our collective response and readiness to a simulated system-wide…

Decision confirmed on 17 September 2024 under-frequency event

We recently consulted with the sector on the draft determination of causer for an under-frequency event on 17 September 2024. An under-frequency event occurred…

Complete our survey on barriers to developing new power generation

The Electricity Authority Te Mana Hiko invites developers to complete a short survey about barriers to progressing new electricity generation projects, to help…