Eye on electricity

Market options were available to large energy users in winter 2024

- Wholesale

- Prices

Business closures prompted the Electricity Authority (Authority) to investigate the options available – we found that hedges available tended to be lower than the overlapping average ASX price.

Over July and into the first week of August, fuel scarcity in the electricity system (limited natural gas supply and low hydro storage) pushed wholesale electricity prices from roughly $300/MWh to over $800/MWh. This exposed unhedged energy users, including several pulp and paper businesses, to very high wholesale electricity prices.

On 10 September, Winstone Pulp International (Winstone) announced it would permanently close its pulp mill at Karioi and its sawmill at Tangiwai. On 18 September Oji Fibre Solutions (Oji) announced it was also closing its Penrose paper recycling mill. Both businesses referred to high energy costs when announcing their decision to close. This prompted the Authority to investigate the market options available to these businesses and consider a review of the stress test regime.

Several North Island wood processors were exposed to the high August wholesale electricity prices, with some curtailing production

We used our statutory information-gathering powers to issue data requests to electricity generators asking for details of their hedge offers to Pan Pac Forest Productions (Pan Pac), Oji and Winstone, for any hedge where at least one date is included in the time span 1 July – 30 September 2024.

Through this enquiry we found that these three industrials were offered a similar quantity of hedges. These hedges had similar characteristics given their size and length. The prices of these hedges were often near the overlapping ASX price. Larger or longer dated hedges were priced below the overlapping ASX price, but the prices for these hedges tended to escalate with inflation.

The following industrial electricity users - all North Island wood processors - were exposed to the August high spot prices to varying degrees:

- Pan Pac, which has a plant in Hawkes Bay.

- Oji, which has three mills - one in Penrose (Auckland) and the others in Kawerau and Tokoroa.

- Winstone, which has two plants near Ohakune.

During the high August prices some of these industrials reduced their electricity consumption.

Then changes in electricity demand, wind generation, gas availability and hydro storage led to the decline in wholesale electricity prices between mid-August 2024 and the daily average national spot price sunk to as low as $1.1/MWh on 1 September.

Our investigation found that hedges available tended to be lower than the overlapping average ASX price

Below we share our analysis of the different market options of three large energy users over July-September 2024 and insights into the hedging options available to them. The purpose of this is to highlight the importance of hedging to manage electricity costs, particularly for businesses where these costs can have a material impact.

Table 1 shows aggregated information regarding all the hedges available to Winstone, Pan Pac and Oji, where these hedges would partially cover their load, for some or all of July-September 2024.

| Median price | Median (price/avg ASX ratio) | |

|---|---|---|

All hedges |

$120/MWh |

0.9 |

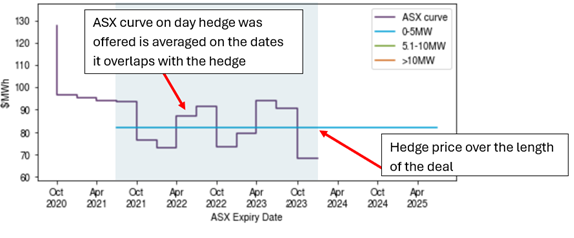

The price of each hedge was compared to the average overlapping ASX price (ie, for dates where the hedge overlapped with the ASX curve available on the date the hedge offer was first made). See Figure 1 for an illustration of how this comparison was carried out.

Our analysis found that smaller hedges, those in the 5-10MW range, tended to have prices which were just below the average overlapping ASX curve. These hedges tended to have a duration of five years or less.

Larger hedges, those 10MW+, tended to be of a longer duration - often more than five years. The larger and or longer deals tended to be priced well below the average overlapping ASX curve (which, as these deals are long-term, would only be occurring at the start of the hedge). Longer deals also tended to include some form of price escalation, which was based on some measure of inflation. Some of these escalations occurred every year, others every five or more years.

The Authority’s review of the stress test regime

Participants retain full responsibility for making decisions on their level of exposure to spot prices, and for managing that exposure on an ongoing basis. All participants exposed to the spot market made risk management decisions regarding their exposure to the spot electricity price over winter 2024.

The Authority’s review of the stress test regime will consider potential enhancements such as extending the stress test horizon to more than the coming quarter to give participant boards an indication of longer-term risk positions and requiring specific information on hedge cover to give an indication of the sector’s actual risk position.

How businesses use hedging to manage the risk of high energy prices

Electricity consumers, including industrial and electricity retailers, can use the ‘hedge’ market to manage their exposure to high wholesale electricity prices - and all market participants make decisions around their hedging position over time. The Authority requires participants to use a standardised series of stress tests to assist them in doing this.

Some businesses see benefits in holding in short-dated hedges, others opt for longer hedges. Some may have both. If a participant holds a hedge, and reduces consumption, they can sell that hedge on without being exposed to the spot price.

Market participants also make decisions on their level of exposure to spot prices, and for managing that exposure on an ongoing basis. There are advantages to being under-hedged, including being able to take advantage of very low prices, however, there are also downsides when spot prices are high.

Related News

Changes in demand and price ‘peakiness’ since 2005

This article analyses long-term trends in electricity demand ‘peakiness’ in New Zealand over the last 20 years. The first half of this article analyse long-ter…

New form of Hedge Settlement Agreement available in 2026

On 1 January 2026, amendments to the Electricity Industry Participation Code will take effect allowing the clearing manager to settle fixed price variable volu…

Selection process starts for over-the-counter trading platform

We've started working with industry participants to select an OTC trading platform that has all the features necessary to deliver voluntary or mandatory market…