Eye on electricity

New Zealand progressing at pace towards a highly renewable electric future

- Generation

- Low emissions

New Zealand is transitioning to a highly renewable electricity system. This change will require increased and accelerated investment in new electricity generation to match demand growth and the retirement of thermal power plants.

As part of the Electricity Authority’s ongoing work to improve visibility of data on new generation investment, we commissioned Generation Investment Surveys in 2022 and 2023. This article explores the uplift of 5.5TWh of new committed electricity generation between these surveys. The Authority is continuously monitoring new investment in the sector and the latest data is available to view in our generation investment dashboard. The priority is that this investment comes to market as quickly as is practicable.

Investment in new electricity generation higher in 2023 than 2022

The Generation Investment Surveys provide valuable insights into the pipeline of investments in new electricity generation. Comparing the survey data between years highlights changes to the pipeline over time, which enables better estimated project delivery times and evaluations for the likelihood of project completion.

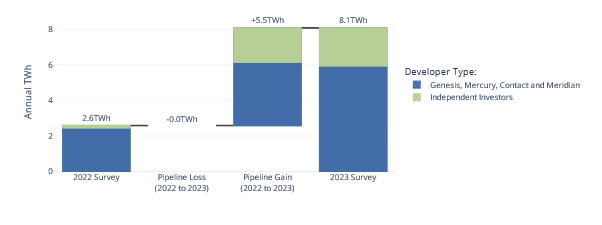

Figure 1 shows the changes to the amount of TWh in the pipeline between 2022 and 2023 when only considering committed projects ie, those where an unconditional final investment decision has been made.

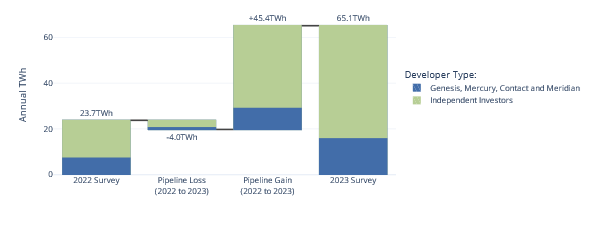

Figure 2 shows the combination of committed and actively pursued projects, where actively pursued projects are those where a site has been identified and the developer has started actively considering at least one of: finance, connection, consents, etc. The green bars show the investment from independent investors, and blue bars are the results from the large electricity gentailers (Meridian, Contact, Genesis and Mercury).

For committed projects, there was a 5.5TWh increase in new electricity generation projects recorded in the 2023 survey compared with the 2022 survey. Committed projects totalled over 8.1TWh, an increase of over 200% from the 2022 survey (Figure 1).

For committed and actively pursued projects, 4TWh of projects in the 2022 pipeline didn’t progress to 2023 (Figure 2). However, a significant amount of new projects, 45.4TWh, were proposed, near double that of 2022.

The two figures also separate investment being pursued by the four large gentailers, Meridian, Contact, Genesis and Mercury (blue) and independent investors (green). In the committed only analysis (Figure 1), the large four gentailers have the greater share of new electricity generation.

When analysing the committed and actively pursued projects (Figure 2) the largest increase in new electricity projects is being funded by independent investors.

New dashboard to monitor new electricity generation

The regular collection and transparency of new generation investment pipeline data is important to enable the Authority to monitor both project competition and its implications on long-term security of supply.

The Authority has created a dashboard which provides ongoing and increasingly sophisticated measurement of key investment data.

There is also a list of 145 investment projects which have been publicly announced (as at June 2024), with information on each project’s status. Projects range in size from 1MW to 1000MW and are predominantly wind and solar, but also geothermal, hydro and battery. They are geographically spread, but mostly in the North Island to match demand. There are also five battery energy storage systems from 100MW to 300MW, with the first 100MW battery (Meridian, Ruakākā) expected to be commissioned in 2024.

The Authority is working to improve the visibility of generation investment, as well as connections of large-scale load, battery energy storage systems, and projects in distribution networks to help with the monitoring long-term security of supply. This information will also help support monitoring of competitive outcomes, and constraints to investment, as well as investment confidence and information for investment decision making.

Related News

Grid-connected solar is having its time in the sun

New Zealand’s electricity system is rapidly building more grid scale solar generation. This generation is beginning to show up in the weekly generation mix and…

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…

How accurate wind and solar forecasts and the new forecasting arrangement are crucial

Last year, the Authority introduced a hybrid forecasting arrangement and awarded DNV Services a contract to provide centralised wind and solar forecasting …