Eye on electricity

New Zealand’s electricity system in August and November 2024

New Zealand’s electricity system is designed to rapidly respond to changing electricity demand and supply conditions. This adaptability ensures the system produces electricity at the lowest cost now, and in the future, and is reflected in varying wholesale electricity prices.

Low hydro storage and limited gas availability drove up wholesale electricity prices in August 2024. However, increased hydro generation and lower demand caused prices to plummet by November. This article explains these differences and why the wholesale electricity price fluctuated between August and November 2024.

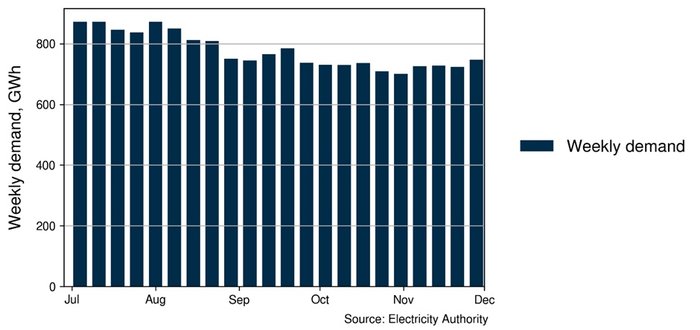

Electricity demand has decreased since August

One of the most notable differences in the electricity system between August and November 2024 was the fluctuation in electricity demand. Weekly demand peaked at 872GWh and decreased to 700GWh in early November 2024 (Figure 1).

A couple of factors contributed to this demand drop. Firstly, the natural decline in demand in spring, as the days get longer and the need for heating reduces. Secondly, the Tiwai aluminum smelter (New Zealand’s largest electricity user), through demand response, reduced its electricity use and national demand by an estimated 330GWh from 10 June to 30 September 2024.

Hydro storage has rapidly increased and thermal generation has backed off since September

Most electricity generation in New Zealand comes from hydro, thermal, wind, geothermal and a small amount of solar. Geothermal generation typically operates at a constant output, and wind and solar generation depend on the weather. Hydro and thermal generation vary depending on fuel availability - stored water for hydro, and coal and gas for thermal.

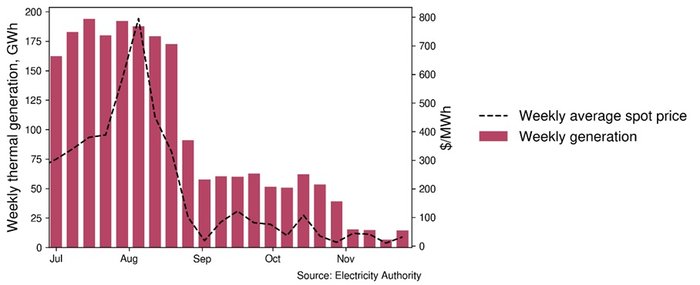

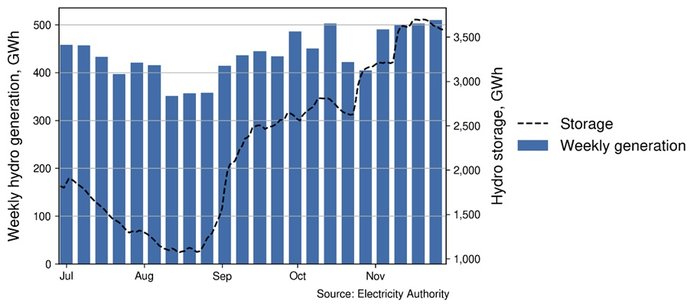

Reduced hydro generation in August meant that more thermal generation ran to meet demand (Figures 2 and 3). Spot prices were also higher in August, reflecting the increasing value of fuel used for electricity generation.

Wet weather in September and October increased hydro storage and generation. Hydro generation was greater in November than August (Figure 3), but demand was also lower (Figure 1).

Improved hydro storage decreased the value of stored water, and together with decreased thermal fuel, this drove spot prices down in November (Figure 2).

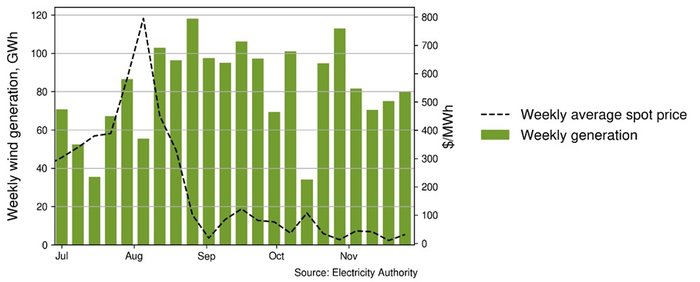

Higher wind generation from September onwards helped depress prices

To accommodate the intermittent nature of wind power, hydro and thermal generation are used to ensure a reliable supply of electricity. In August 2024, demand was high and hydro generation reduced to conserve declining hydro storage (Figure 3).

Wind generation has varied since July (Figure 4). Wind generation has no fuel cost, so periods of higher wind lead to lower spot prices and vice versa.

Thermal fuel stockpiles have increased since August

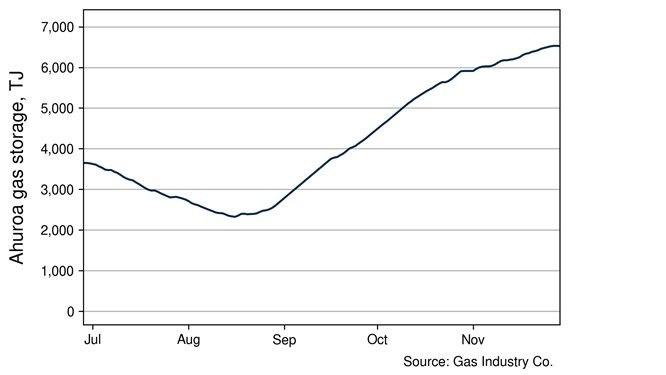

Higher proportions of renewable generation have enabled thermal fuel stores to replenish in recent months. Gas storage at Ahuroa increased by 3,760 TJ between August and the end of November (Figure 5, Source Gas Industry Co). Thermal stockpiles provide a contingency supply of energy for times when hydro storage runs low.

Changes in future fuel outlook are reflected in the electricity risk curves

The system’s adaptability is evident in the shift in fuel use and pricing between August and November. In August, the system prioritised water conservation to prevent future blackouts, resulting in increased thermal generation. However, once hydro storage increased throughout late August and early September, the system rapidly switched to using more hydro generation, which enabled thermal fuel stockpiles to increase.

The industry and electricity consumers can anticipate future fuel stress by analysing the system operator’s electricity risk curves. These curves, which establish critical hydro storage thresholds, serve as early warning signals for impending fuel shortages. As hydro storage nears the thresholds, the risk of blackouts escalates, prompting industry action.

The system operator updates the electricity risk curves monthly as future fuel projections change.

What we are doing to encourage future resilience

The Electricity Authority, as the regulator, is focused on enabling more investment in generation, and harnessing opportunities from new technologies and demand response to keep the lights on at an affordable price. We are updating the rules and regulatory settings to ensure they support the integration of new technologies, they enable flexibility, and improve the resilience of Aotearoa’s electricity networks.

In August 2024, we established an Energy Competition Task Force with the Commerce Commission in response to high wholesale prices to investigate ways to improve the performance of the electricity market.

The Task Force’s work programme focuses on two overarching outcomes:

- enabling new generators and independent retailers to enter, and better compete in the market

- providing more options for end-users of electricity.

These outcomes will encourage more and faster investment in new electricity generation, boost competition, enable homes, businesses and industrials to better manage their own electricity use and costs, improve electricity supply and put downward pressure on prices.

Related News

Update on our distributor guidance to support a competitive flexibility services market

We’re finalising our ‘Guidance for distributors involved in the flexibility services market’, which is expected to be published in early 2026.

Sarah Gillies: Ngā mihi nui from the Authority

As we head into the holiday season, I want to say a heartfelt thank you to everyone who engaged with the Authority this year.

How marginal electricity spot pricing reflects cost

In the New Zealand wholesale electricity market, the price paid to dispatched generators is the nodal ‘spot price’, which is priced to reflect the ‘margina…