Eye on electricity

The difference between winter peak capacity and dry year risk

- Generation

The New Zealand electricity system provides reliable electricity around the clock, however, the system faces some challenges in achieving this. One issue is having enough ‘generation capacity’ during ‘winter peak demand’, and another is having enough ‘fuel’ during a ‘dry year’.

This article explains both issues and how the Electricity Authority Te Mana Hiko (Authority) and the industry are working to provide more flexibility for the electricity system to mitigate these challenges.

Winter peak capacity issues usually occur on cold nights and frosty mornings

In New Zealand, electricity is produced by renewable sources like wind, hydro, solar and geothermal, and by non-renewable, thermal-fuelled power stations. Winter sees the highest demand for electricity, usually during cold evenings or on frosty mornings when electric heating ramps up. Also, unseasonably cold weather in autumn or spring may cause high demand periods.

The ‘winter peak capacity’ issue reflects the ability of the electricity system to meet high winter demand. This issue arises from the nature of certain types of electricity generation.

Typically, solar does not produce electricity during peak demand periods, as it is dark. Wind generation (~10% of New Zealand’s electricity generation capacity and growing) isn’t reliable as cool temperatures may bring low wind speeds. This leaves hydro, geothermal and thermal generation to provide the bulk of electricity during high demand periods. Geothermal generation already runs at near full capacity, so only thermal and hydro can ramp up and down to meet winter peaks.

Thermal generation can be non-economic to run, even in winter

New Zealand’s thermal generation comes in two types: large slow start units which provide baseload generation, and fast start generation, which often only run during peak demand periods. Problems can arise during winter if one or more thermal units aren’t running due to the current price signals.

The large units can take over 12 hours to start, so prices in the forward schedules must be economic to start the units. This is often referred to as ‘thermal commitment’. However, prices before peak demand periods can be low, due to high amounts of renewable generation or forecasting errors. This could discourage generators from starting thermal units for peak periods.

In 2023, the Authority worked with the System Operator to publish sensitivity schedules to help the industry understand prices if demand varies from the forecast demand schedule (or if wind were to drop). This information supports generators to make better decisions around when to turn thermal units on. It also signals to consumers who are exposed to the spot market1 when to respond to potentially high prices by reducing their electricity demand.

The Authority also held consultations in early 2024 on potential solutions for peak electricity capacity issues after feedback from the 10 May 2024 low residual situation. Work is underway to develop a range of solutions to support security of supply including acceleration of demand response participation, changes in market settings and promotion of flexibility and competition.

Dry year risk can occur when rainfall into New Zealand’s hydro lakes is below average

New Zealand’s electricity generation capacity is over 50% hydro generation, with many schemes having storage reservoirs which conserve water for later use.

The ‘dry year risk’ occurs when low rainfall sees the hydro lake levels fall below average for an extended period. This can occur during any season, but is intensified in winter when electricity demand is highest.

During times of hydro reservoir decline, hydro generation is priced to reflect the increasing scarcity of water. Currently, more thermal generation often comes online during a dry year, resulting in higher average electricity spot prices.

New Zealand faces a challenge in managing the dry year risk as its transitions towards a highly renewable power system. While solar and wind can store some excess energy using batteries, this is limited to only a few hours worth of electricity, and isn’t enough to manage a situation where rainfall is below average for weeks to months. Solutions to the dry year risk are being explored and include options like pumped hydro schemes, peakers and baseload thermal running on renewable fuels (like hydrogen or wood pellets) or expanded renewable energy supply with large batteries.

New technologies and approaches can help alleviate both problems

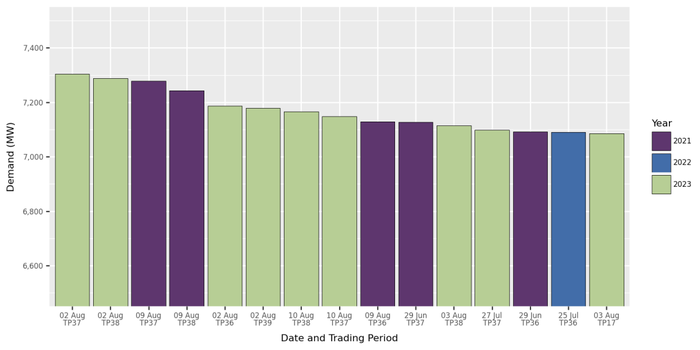

The issue of winter peak electricity demand may be exacerbated in the coming years as peak demand periods grow. The top 15 largest peak demand periods2 have all occurred between 2021-23, as shown in Figure 13. The electricity system is evolving to address increasing demand. The further development of geothermal units, which provide additional baseload generation, greater deployment of demand response, and the expansion of battery storage systems, will help provide more flexibility on the electricity system to manage future peak periods. No trading periods from 2024 appear, likely due to more demand response being used to manage the dry winter.

The electricity industry is working to address the dry year risk. However, new innovations and the building of more generation (like more geothermal stations), more batteries and renewables, demand response and increasing interest in green fuels (like wood pellets and hydrogen) signal that these solutions will include many moving parts.

1. Mostly industrial consumers.

2. Since 1996.

3. The electricity systems works on a 48 trading period system, with two trading periods every hour. Trading period 1 is equal to 12:00am and trading period 48 is 11:30pm.

Related News

How marginal electricity spot pricing reflects cost

In the New Zealand wholesale electricity market, the price paid to dispatched generators is the nodal ‘spot price’, which is priced to reflect the ‘margina…

New generation projects flowing through the investment pipeline

New electricity generation projects are expected to significantly boost New Zealand’s energy system over the next two years. As at October 2025, there were 28…

Future System Operation project - update and next steps

Following consideration of feedback, engagement with submitters and additional analysis, the Electricity Authority Te Mana Hiko has revised the next steps …