Eye on electricity

What is behind low wholesale electricity prices

Our previous ‘Eye on electricity’ article explained how high wholesale electricity prices in early August 2024 reflected fuel scarcity in the electricity system – as natural gas production has declined and hydro storage was low.

This article explains how changes in electricity demand, wind generation, gas availability and hydro storage led to the decline in wholesale electricity prices between mid-August 2024 and early September, and what the Authority is doing to strengthen the market.

Electricity demand decreased in August as industrial load dropped and spring temperatures soared

Electricity demand in New Zealand is split between industrial, commercial and household users, with each sector consuming roughly one third of New Zealand’s total electricity.

Between June and early August 2024 some large industrial electricity users reduced or paused production to avoid high wholesale electricity prices they were exposed to.

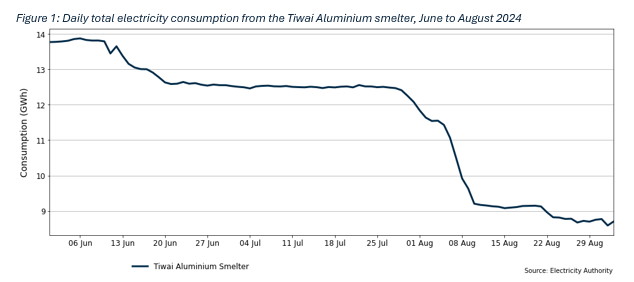

New Zealand’s largest electricity user, the Tiwai Aluminum smelter, also began turning down its electricity demand in June, as part of a negotiated deal with its electricity provider, Meridian Energy (see Figure 1).

In May 2024, Meridian Energy announced a new deal to supply electricity to the Tiwai smelter, which consumes roughly 10% of New Zealand’s electricity. This deal allows the smelter to engage in greater ‘demand response’ – where Meridian pays the smelter to reduce their electricity consumption. This enables the smelter to remain economically viable while it has turned down production, and for Meridian to conserve more water in their hydro storage schemes.

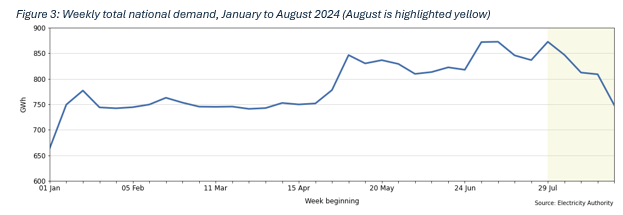

Household demand for electricity in New Zealand is highly seasonal. Typically, national demand for electricity peaks sometime in July and August and then declines as spring brings warmer weather and longer days.

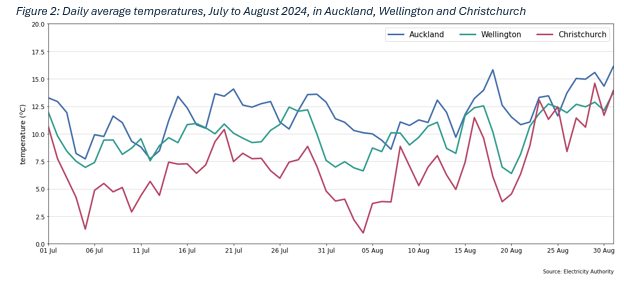

In 2024, New Zealand experienced cold weather in July and early August, with the resulting higher electricity demand pushing up electricity wholesale prices - during a time of low fuel availability. But surprisingly warm days toward the end of August (see Figure 2) reduced household electricity consumption.

The combination of industrials ramping down, or turning off, and warm temperatures caused total weekly demand for New Zealand to dip below 750GWh for the final week of August, which is the lowest value since mid-April (see Figure 3).

Thermal generators negotiated a deal for more gas

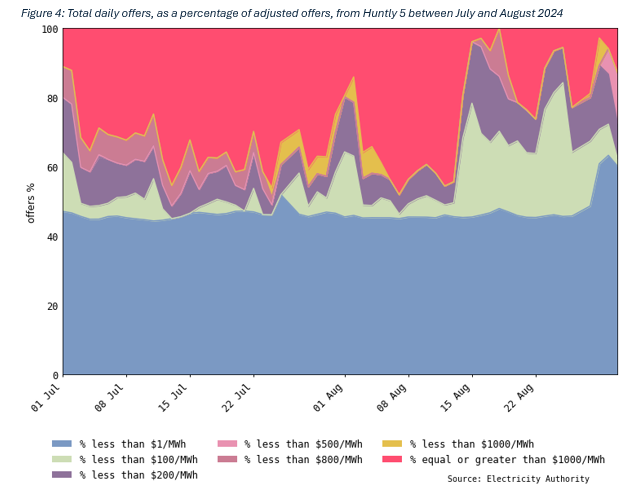

In July and early August 2024, the electricity system was heavily reliant on gas and coal fired generation. However, this increased need for natural gas was matched against a declining gas supply, which pushed up gas prices.

In mid-August, Contact Energy and Genesis Energy negotiated a deal to buy natural gas from Methanex, the country’s largest natural gas user. This allowed Genesis to reduce the price of producing energy from Huntly 5 – the country’s largest gas fired electricity generating unit. This can be seen in the large increase in offers priced between $1-99/MWh (green) and $100-199/MWh (purple) from mid-August onwards (see Figure 4).

Wind generation set new records in late August

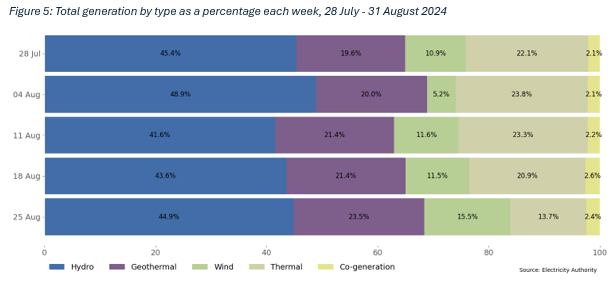

During the period of highest prices in early August, wind generation was low, but then picked up significantly. In late August, New Zealand experienced the highest proportion of electricity generation from wind on record, at over 15% (see Figure 5).

High wind generation, combined with reduced demand, saw some large thermal generators like Huntly 5 turned off overnight after 31 August. TCC, another large gas fired unit, also switched off completely on 30 August, reducing the total proportion of electricity being produced by thermal power plants during the final week of August (see Figure 5).

Increasing hydro storage means hydro generation is cheaper to run

Alongside these windy conditions came both rain and snow. The increasing snowpack will contribute to hydro storage as this snow melts in spring. Some of the hydro lakes have between 20-70% of their yearly inflows from snowmelt.

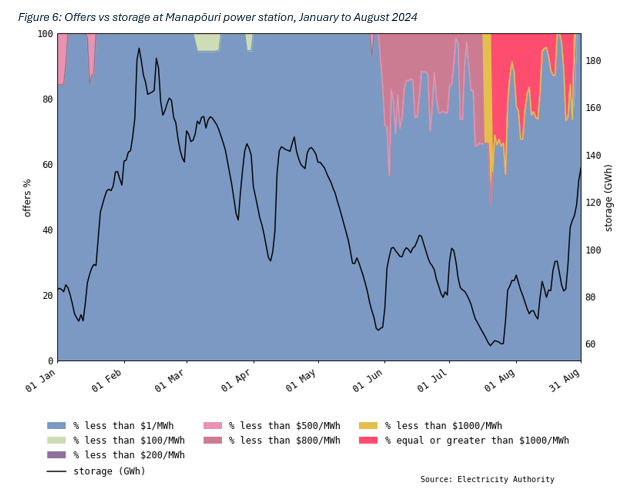

More immediately, this rainfall has increased storage in several hydro lakes, changing the value of their storage water. For example, generation at the Manapōuri power station, New Zealand’s largest hydroelectric power plant, was all below $1/MWh by late August (see Figure 6). Other large schemes, like the Waikato and Waikati, also saw decreases in offer prices after hydro storage increased.

The market will continue to respond to demand and supply conditions

While wholesale electricity prices have been low in late August and early September, there is no certainty these prices will stay. While hydro storage has increased dramatically in recent weeks, total storage remains at roughly average for this time of year. Persistent dry weather in spring or windless days could once again increase the electricity system’s reliance on thermal generation. Also spring cold snaps could increase electricity demand, which could see wholesale prices change to reflect these conditions. Additionally, the Methanex gas swap will end in October, and the Tiwai Aluminum Smelter will likely increase its electricity consumption again sometime in September.

Market participants need access to risk-management products to help them operate through volatility in prices. The Authority has developed a range of risk management tools over the years and is working to ensure these remain fit for purpose and enable competition.

A risk management review is underway and is weeks away from reporting on findings about whether the current approach to pricing over-the-counter risk management contracts is hindering retail market competition.

As New Zealand develops more intermittent generation, like wind and solar, electricity supply needs to be firmed with generation from flexible generation such as hydro. We are working on developing a standardised flexibility product. Access to flexibility contracts will act as “insurance’ for firming and give participants another tool to manage financial risk, particularly during periods of volatility.

The Authority has also recently established an Energy Competition Task Force with the Commerce Commission. Together, we are looking at ways to strengthen the market by boosting competition, encouraging more investment in new generation and putting downward pressure on prices. Last week we announced eight initiatives that the task force is looking at to improve the electricity market’s performance and we will report on progress on a monthly basis.

Related News

Electricity Authority lodges formal complaint over alleged Code breach

The Electricity Authority Te Mana Hiko has lodged a formal complaint with the Rulings Panel alleging a breach of the Electricity Industry Participation Code 20…

Exemptions from the Code for 2025

This year, the Electricity Authority Te Mana Hiko approved 11 exemptions and three exemption amendments from obligations in the Electricity Industry Particip…

Seeking feedback on 11 July 2025 under-frequency event

The Electricity Authority Te Mana Hiko is seeking feedback from participants who may be substantially affected by the under-frequency event of 11 July 2025.