Eye on electricity

What was behind high wholesale electricity prices

- Generation

- Wholesale

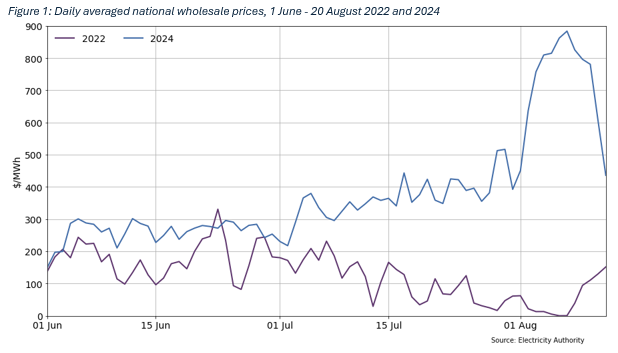

Between July and early August 2024, New Zealand’s wholesale electricity prices increased from roughly $300/MWh to over $800/MWh. This article explains how the supply of electricity, matched to winter demand, resulted in these wholesale electricity price increases. It also explains how most households are protected from these prices, how industrial customers can insulate themselves from the volatility in the wholesale market, and what the Electricity Authority is doing about the electricity price spike.

Electricity prices are determined by supply and demand conditions

The electricity wholesale spot price is determined by the supply and demand for electricity. The cost of producing electricity is determined largely by what proportions of hydropower, wind, solar, geothermal and thermal fuels are used to meet demand.

Generation like solar, wind and geothermal have low running costs, so they are offered into the electricity market at low prices. However, hydro and thermal generation have costs associated with their fuel.

When expensive or scarce fuels are used to generate electricity, or if demand for electricity is high, like during winter, the wholesale electricity price reflects these conditions.

Low hydro storage pushed up the value of hydro generation

New Zealand’s electricity generation capacity is over 50% hydro generation, with many schemes having storage reservoirs which conserve water for later use. While this enables New Zealand to generate mostly renewable electricity, it leaves the system exposed to the risk of ‘dry years’, when hydro storage is consistently below average. Since New Zealand is dominated by hydropower, the electricity market is sensitive to hydro storage levels.

The price of producing electricity from hydro generation reflects the amount of water currently stored. The price falls to cents when the hydro lakes are nearly full, but when storage declines, prices rise to reflect the stored water’s increasing scarcity. Higher hydro prices reflect the risk of running out of hydro storage altogether and make more expensive thermal generation viable.

Between April and August 2024, hydro storage steadily declined, with storage reaching a six-year low in early August. During this decline, electricity generation from hydropower was sold at higher prices into the wholesale market.

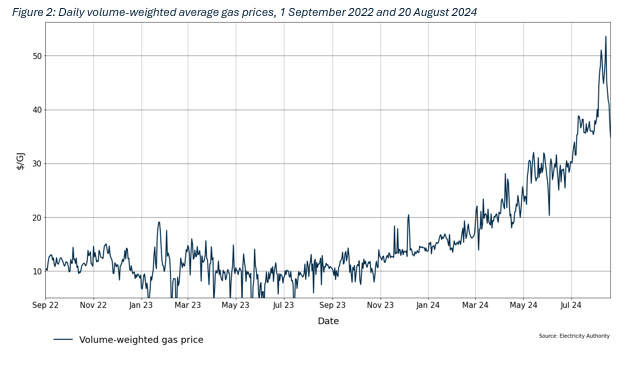

Declining supply, and higher demand, pushed up the price of natural gas

For thermal generation, the cost of sourcing its fuels, either natural gas, coal or diesel, which are burned to generate electricity, largely dictate its price in the electricity market.

Most thermal generation in New Zealand is gas powered, except for the Huntly Rankines which can use either gas or coal, and Whirinaki, which uses diesel. When hydro generation output is low, as in a dry year, thermal generation will increase its output to cover the difference, which usually increases electricity wholesale prices.

Natural gas production from some fields in New Zealand has declined, which is expected as gas fields deplete, unless investment is made to restore output.

While hydro storage was declining in 2024, thermal generation increased its output. This increased the demand for natural gas, which when matched against a declining gas supply, pushed up gas prices (see Figure 2). The price of gas was then reflected in the electricity wholesale prices.

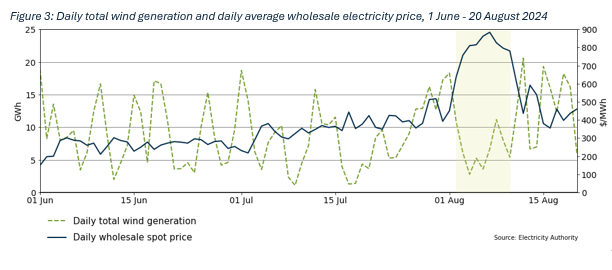

Wind generation was low in early August, despite new wind farms

When wholesale prices were highest in early August 2024, wind generation was often generating below 300MW, despite national wind capacity of over 1,000MW. These lulls in wind generation, together with declining hydro storage and high gas prices, led to wholesale electricity prices reaching over $800/MWh at times (see Figure 3, yellow highlight).

Prices in winter 2024 reflected tight fuel conditions

Several different factors coincided over July and into early August to push up wholesale electricity prices. Firstly, hydro storage had steadily declined since the last major inflow in April, and overall hydro storage levels had been mostly below the historic mean since August 2023. Since electricity in New Zealand is heavily dependent on hydro generation, when lake levels are declining, the value of the water in reservoirs increases. Secondly, the price of natural gas, which is used more when hydro storage is low, increased at the time, due to declining supply and additional gas demand. Lastly, when wholesale prices were highest, wind generation had usually been low.

In the short term, these high wholesale prices reflected the risk of running out of stored water, which could have led to rolling blackouts. As storage declined, many hydro operators raised their offers to discourage hydro-dispatch, with other available generation instead being used, including thermal generation. This ensured future hydro storage wouldn’t run out.

In the long term, high wholesale prices act as a signal to investors that more generation is needed to meet demand. Many developers have already reacted to wholesale price trends, and more renewable generation is being built to meet future demand. This investment pipeline can be viewed on the Electricity Authority’s investment dashboard. The priority is that this investment comes to market as quickly as is practicable.

Most consumers are insulated from volatile wholesale prices

Wholesale electricity price volatility, with some periods of low prices and others with high prices, is expected to persist as New Zealand transitions to a highly renewably electricity system. Periods with abundant water, wind and sunshine will see extended periods of low wholesale electricity prices. However, during times of low hydro storage, additional thermal generation (potentially green peakers in future), large scale batteries, or demand response will cover the difference, which could cause wholesale prices to spike.

Households and small businesses are protected from the current wholesale price volatility by paying a fixed cost for electricity. Industrial participants can use the ‘hedge’ market to manage their exposure to wholesale electricity prices.

The Authority constantly monitors electricity offers and prices, and acts if needed

The Authority monitors the market and the activity of industry participants to ensure wholesale prices reflect the underlying supply and demand conditions in the market. We publish weekly trading conduct reports, and if suspected instances of non-compliance with the high-standard-of-trading-conduct rule are flagged, these are marked for further analysis. This may involve asking participants for information they hold in relation to the period of interest. These cases may be passed on to the Authority’s compliance team, with the ability for cases to be elevated to the Rulings Panel if there is a potential Code breach (and where appropriate according to our compliance strategy and policies).

We also conduct quarterly market performance reviews, to further analyse and evaluate whether prices are reflective of market conditions.

The Authority has highlighted prices between 1 July and 23 August 2024 for further analysis. Data on the energy margins generators are making when selling into the wholesale electricity market are available in our Energy Margin Dashboard and are updated weekly.

The Authority has also recently established an Energy Competition Task Force with the Commerce Commission. Together, we are looking at ways to strengthen the market by boosting competition, encouraging more investment in new generation and putting downward pressure on prices. Last week we announced eight initiatives that the task force is looking at to improve the electricity market’s performance.

Related News

Hydro storage limits and why rain matters for electricity

New Zealand has a highly renewable electricity system where hydro generation accounts for more than half of our total electricity generation. This article expl…

Gentailer energy margins in 2024

Following the significant spike in wholesale electricity prices during July and August 2024, the Electricity Authority Te Mana Hiko requested that all gentaile…

New deadline for level playing field measures submissions

In response to submitter requests for additional time, we have extended the closing date for submissions on our Level playing field measures options paper by t…