General news

What we’re doing about the electricity price spike

- Wholesale

- Prices

This week

- Emergency board meetings to ensure all options are on the table

- Investigation into why prices are so volatile and so high

- Working with Transpower to release contingent storage to allow more hydro generation which should ease price pressures

Next week

- More regulatory initiatives under consideration

- Publication of first data on price volatility

Already underway

- Ramping-up monitoring of new investment projects – what is being built and when

- Looking at availability and pricing of risk management options - for example access to hedges and fixed price contracts.

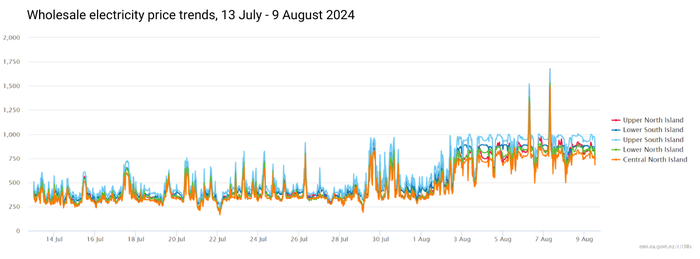

Wholesale electricity prices have risen sharply in recent weeks which illustrates the stress the market is currently experiencing.

A shortage of gas combined with low rain and inflows into our hydro lakes has created a severe fuel shortage, driving up prices.

The dry winter and gas shortages has created something of a perfect storm and while there is no silver bullet solution, we’ve already moved to make sure the market is working effectively and to increase surveillance of gentailers and other market players.

The biggest issue right now is supply. As a country, we simply don’t have enough “fuel” in the system to deliver the energy we need in an affordable way.

The Electricity Authority is not comfortable with the current high prices and we have moved swiftly to make sure the market is working properly.

We are using all our powers to drill into why prices are so volatile and so high. We monitor market behaviour every week but this work goes even further.

From next week we will be publishing new analysis to see what lies behind the current prices as the fuel shortage that we’re experiencing can only explain so much.

We will be testing to see if the prices are justifiable in the circumstances, which is why we are digging deeper and making the companies give us more information, so everyone can see exactly who is making what and to shine a light on the current situation.

In addition, we are working with Transpower to explore a range of other options. Transpower is working to bring forward the ability for hydro generators to access contingent storage (allowing temporary lowering of hydro lake levels) without breaching resource consents to provide more generation capacity earlier.

New Zealand is already at a tricky stage in our transition to a more sustainable energy system and the dry winter and gas situation is putting immediate pressure on our wholesale market.

We’ve been planning for this energy transition for some time, and as a regulator it is up to us to ensure the industry’s pace of change matches the pace of the transition.

It is not acceptable for consumers - large and small - to be carrying the full cost of the transition for the next couple of years - until new generation comes online and other innovations start to relieve the price pressures we are seeing now.

Investment in new generation has a massive role to play and a lot of market uncertainty has been removed in recent times.

The new Tiwai contracts are for 20 years rather than the previous short-term deal, the Lake Onslow proposal is no longer going ahead and we at the Authority have a multi-year plan to give regulatory certainty.

It’s good that investment in new generation is being made. Our research shows it has doubled in the space of 18 months – with about 30% coming from new generators entering the market.

We have also ramped up our reporting and monitoring of that new investment because it’s important for New Zealand that what is being announced is being delivered in a reasonable timeframe.

We already have a review of risk management options and a number of market enhancements to improve things and prepare for the future that is coming at us quickly.

But there is no quick fix.

As the regulator we’re focused on using our powers to ensure the market is working effectively and new investment is encouraged because ultimately that is the only way out of this.

Sarah Gillies, CE Electricity Authority

Related News

New deadline for level playing field measures submissions

In response to submitter requests for additional time, we have extended the closing date for submissions on our Level playing field measures options paper by t…

The system operator invites participants' feedback

Transpower is surveying market participants to contribute to the Authority’s annual assessment of their performance as system operator, and how it can better s…

Strengthening the wholesale market for winter 2025

We are progressing recommendations from the 2023 Market Development Advisory Group report to strengthen competition and support security of supply for winter 2…